RBI Enters as Saviour; Nifty Closes Above 17k! - Post Market Analysis

NIFTY opened the day at 16,798, with a gap-down of 20 points. The index tried to move up but was waiting for RBI updates. It suddenly fell to the day's low just after the rate hike announcement. It was an amazing move from there and easily broke 17k and 17,100 resistance. But Nifty failed at the 17,180 level, and closed the day at 17,094, up by 276 points or 1.64%.

BANK NIFTY started the day at 37,660 with a gap-up of 12 pts. It showed strong upside momentum without any looking back. After breaking 38,500 resistance, it hit a day high above 38,800. Bank Nifty closed at 38,631 up by 984 points or 2.61%.

All the indices ended in the green, led by Nifty PSU Bank (+3%), Nifty Realty (+1.9%), Nifty Metal (+2.1%), and Nifty Auto (+1.6%).

Major Asian Markets closed mixed with weakness. European Markets are now trading 1% down.

Today’s Moves

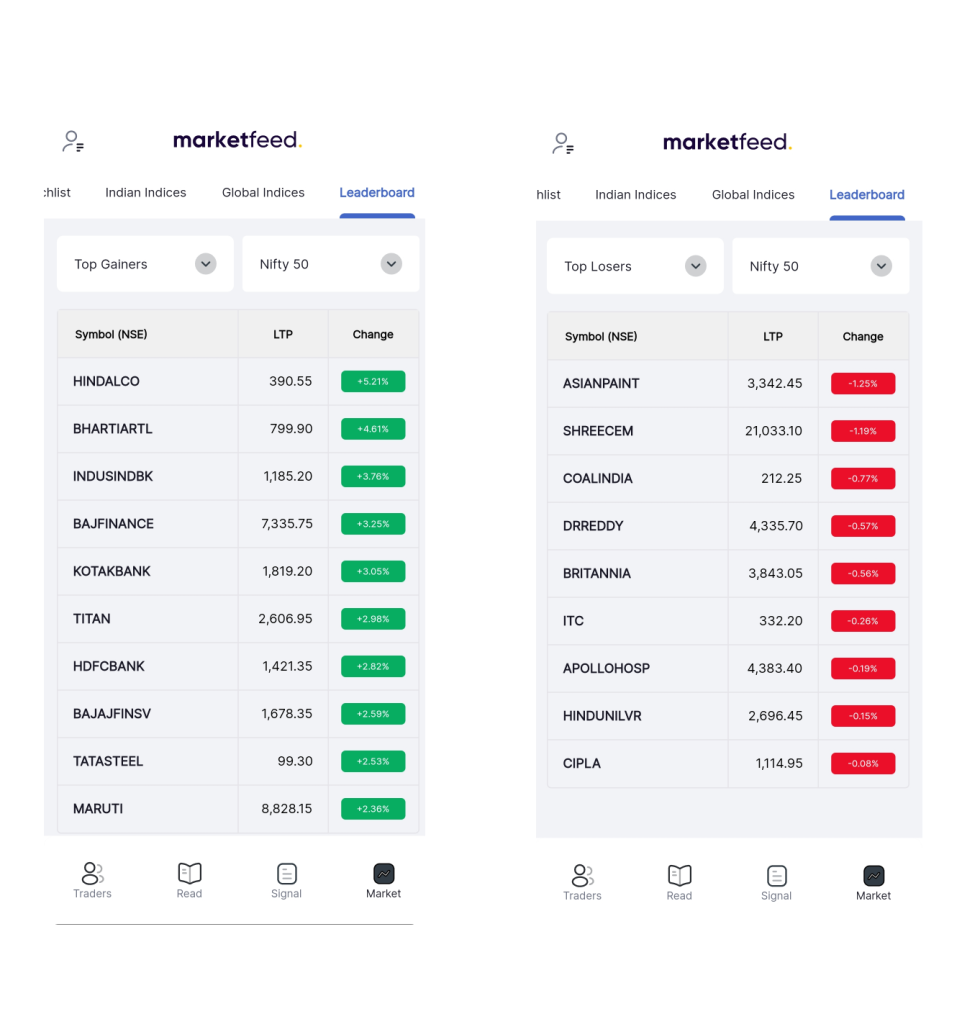

Hindalco (+5.2%) once again gained and closed as the Nifty 50 Top Gainer.

Asian Paints (-1.2%) closed as Nifty 50 Top Loser as crude oil prices sustain the up move.

All the Bank Nifty stocks moved up after RBI updates. AU Bank (+3.1%), Axis bank (+1.9%), Federal bank (+5%), HDFC Bank (+2.8%), ICICI Bank (+2.1%), IDFC First bank (+4.4%), IndusInd Bank (+3.7%), Kotak Bank and SBIN (+1.7%) moved up.

Other financial stocks- Bajaj Finserv (+2.5%), Bajaj Finance (+3.2%), also moved up.

Telecom companies- Reliance (+2.2%), Bharti Airtel (+4.6%), and Vodafone Idea (+3.5%) moved up ahead of the 5G launch tomorrow.

City gas distributors- IGL (-5.5%), MGL (-4.7%) and GujGas (-2.5%) fell the most from FnO segment.

DBL(+3.9%) secured a metro project worth Rs 723 crores.

Heritage Foods (+7.6%) announced the issue of equity shares in the ratio of 1:1 via a rights issue.

Share of India Cements (+9.5%) gained well on UltraTech Cements’(+1.2%) plan to acquire its project in Madhya Pradesh.

Markets Ahead

The day was all about RBI announcements.

Even though U.S markets fell yesterday, we opened flat today as everyone was eagerly waiting for RBI updates.

Today, RBI announced a rate hike of 50 basis points to 5.90%, as expected. There were no surprise announcements, but RBI Governor was very positive about our economy. Let's check some points.

- Bank credit has grown 16.2% in September (YoY) and the flow of financial resources has improved.

- Real GDP growth for FY23 is expected at 7% vs 7.2% earlier.

- India Rupee is performing better than its peers.

The market was fueled by strong comments from RBI and Nifty broke multiple resistances. But this cannot be considered a recovery signal. We need to watch the market for at least three trading days and the Nifty should close well above 17k.

Bank Nifty falling below 38,500 was a big concern this week. But if 39,400 is broken in the coming days, our market could escape from the volatility.

Reliance was super bullish from opening itself, powered by the launch of 5G services tomorrow.

HDFC Bank broke 1400 resistance and closed around 1421, and it's a great relief.

U.K. Q2 GDP (QoQ) was posted at 0.2% vs -0.1% previous.

Are you excited about the 5G launch? How much extra money (in %) are you ready to pay for new 5G offers in the coming months? Share your answers in the comments section of the marketfeed app.

Post your comment

No comments to display